Tired of hiring and managing Accountants !

May 1, 2025

The Hidden Struggles of Hiring Full-Time Accountants and How Third-Party Services Can Help

What do you think the the Real Challenge is: Why Hiring Full-Time Accountants Is a Struggle for Small and Medium Businesses

For small and medium-sized businesses (SMBs), maintaining a good accounting system is critical, but hiring and managing a full-time accountant often turns into a daunting task.

With limited budgets and resources, these organizations face unique challenges that can disrupt their financial stability and growth.

So Let’s not write more and start to break down the key problems allinging the topic:

1. High Costs of Recruitment and Salaries

Hiring a full-time accountant involves significant expenses that many SMBs struggle to afford. Recruitment costs, including job postings, agency fees, and interview processes, can quickly add up. Once hired, a qualified accountant’s salary—often starting at a premium due to their expertise in accounting standards and taxation toos. This financial burden can force companies to compromise on quality, leading to poorly managed finances.

2. High Turnover and Transition Gaps

Turnover is a common issue in the accounting field, especially for SMBs that can’t offer competitive salaries or growth opportunities compared to larger firms. When an accountant resigns, the business faces a gap period—sometimes weeks or months—while searching for a replacement. During this time, financial records may go unmonitored, invoices unpaid, and compliance deadlines missed, risking penalties or financial discrepancies. The cost of turnover isn’t just financial; it’s operational, as the lack of continuity disrupts workflows and decision-making.

3. Limited Expertise and Scalability

Small businesses often hire accountants who are generalists rather than specialists due to budget constraints. However, as the business grows, the complexity of financial needs—like tax planning, international compliance, or audit preparation—increases. A single accountant may lack the expertise to handle these evolving demands, leaving the business vulnerable to errors or missed opportunities. Additionally, scaling up by hiring more staff isn’t feasible for SMBs with tight budgets, creating a bottleneck in financial management.

4. Time-Intensive Management and Training

Managing a full-time accountant requires significant time and effort from business owners or managers, who are often already stretched thin. Onboarding a new hire, training them on company processes, and monitoring their performance can take weeks or months. For small teams, this diverts attention from core business activities like sales, product development, or customer service. If the accountant underperforms or makes errors, the business owner must step in to correct issues, adding to the workload and stress.

5. Risk of Non-Compliance and Financial Errors

SMBs often lack the resources to stay updated on changing tax laws, corporate regulations, and international accounting standards. A full-time accountant who isn’t well-versed in these areas can inadvertently lead to non-compliance, resulting in fines, penalties, or legal issues. For example, missing a tax filing deadline due to an accountant’s oversight can cost a business thousands in penalties. Similarly, errors in financial reporting can misrepresent the company’s health to stakeholders, eroding trust and credibility.

A Smarter Solution: Leveraging Third-Party Services for Accounting Needs

For small and medium-sized businesses with limited budgets, outsourcing accounting to third-party services offers a cost-effective, scalable, and efficient alternative to hiring full-time accountants. These services are designed to address the specific challenges SMBs face, providing expert support without the overhead of in-house staff. Here’s how third-party services can help:

1. Cost-Effective Access to Expertise

Third-party accounting services allow SMBs to access a team of experienced professionals at a fraction of the cost of a full-time hire. These providers employ accountants well-versed in international standards, tax laws, and corporate compliance, ensuring high-quality financial management without breaking the bank.

2. Seamless Coverage During Transitions

Unlike a full-time accountant, third-party services provide consistent support, eliminating the risk of gaps during resignations or leaves. These providers have teams in place to ensure continuity, meaning your financial records are always up-to-date, invoices are processed on time, and compliance deadlines are met. For SMBs, this reliability is invaluable, as it minimizes disruptions and keeps operations running smoothly.

3. Scalable Solutions for Growing Businesses

Third-party services are inherently scalable, making them ideal for businesses with fluctuating needs. As your company grows, these providers can adjust their services—whether that’s handling more complex tax planning, preparing for audits, or supporting international expansion. This flexibility allows SMBs to access specialized expertise on demand, without the need to hire additional full-time staff. For example, during tax season, you can scale up support for filings and then scale back to basic bookkeeping afterward, optimizing costs.

4. Reduced Management and Training Overhead

Outsourcing accounting eliminates the need for in-house management and training. Third-party providers handle their own staff, ensuring they’re trained, monitored, and up-to-date on the latest regulations. This frees up business owners to focus on core activities like growing their customer base or improving products. With the provider managing the accounting team, you get peace of mind knowing your finances are in expert hands without the hassle of oversight.

5. Enhanced Compliance and Accuracy

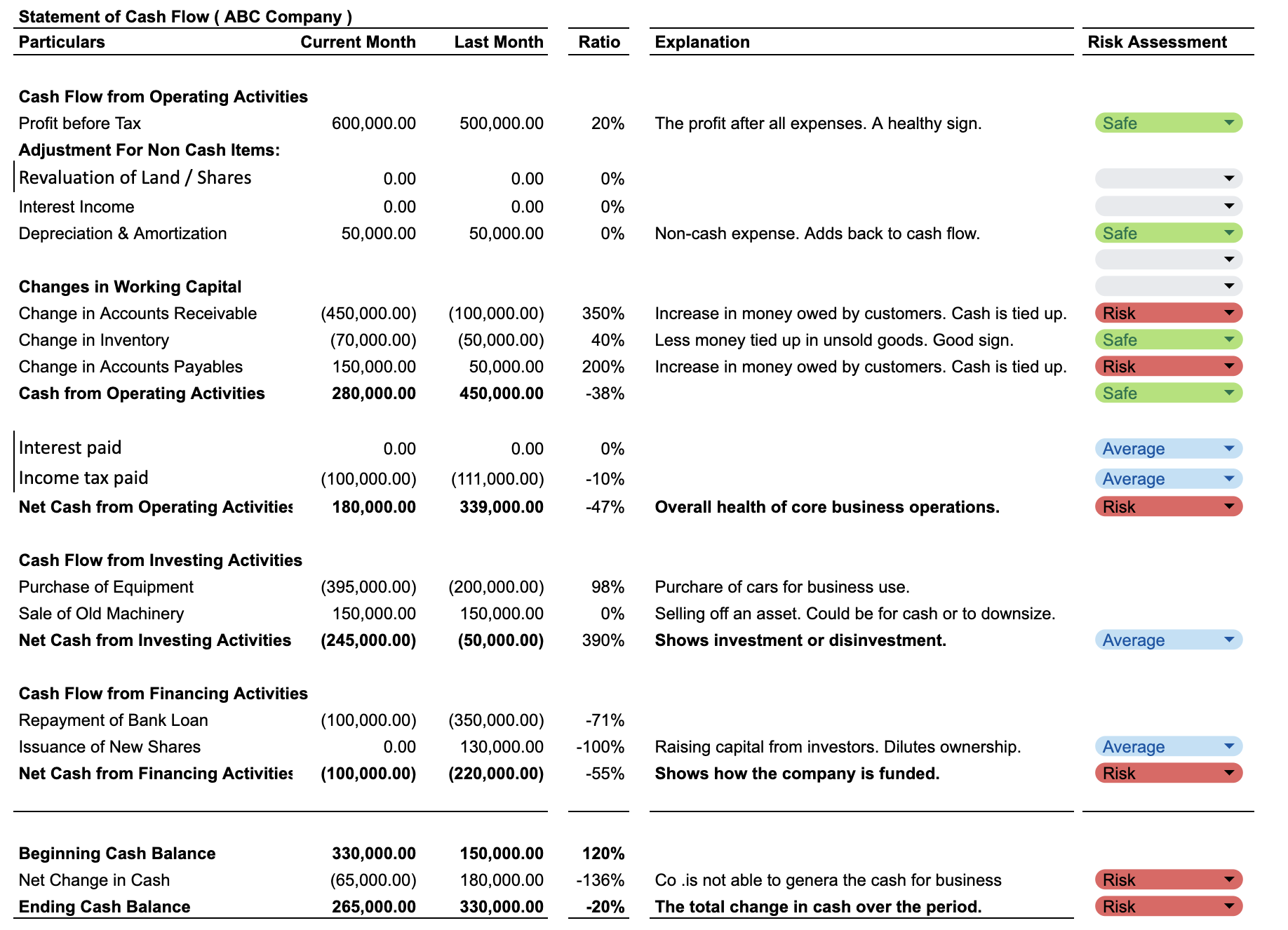

Third-party services specialize in staying current with tax laws, corporate regulations, and accounting standards. Their teams are equipped to handle compliance requirements, reducing the risk of penalties or legal issues. Additionally, these providers often use advanced software to automate and streamline processes, minimizing human error in financial reporting. For SMBs, this means accurate, transparent records that build trust with stakeholders and support informed decision-making.

6. Additional Support for Financial Growth

Beyond bookkeeping, many third-party services offer value-added solutions like financial consulting, tax planning, and audit preparation. For small businesses, this means access to strategic insights—such as optimizing cash flow or identifying cost-saving opportunities—that would typically require a CFO, a role most SMBs can’t afford. These services help businesses not only maintain their finances but also grow sustainably, even on a tight budget.

Why Third-Party Services ?

For small and medium-sized businesses, the decision to outsource accounting to a third-party service can be transformative. It addresses the core challenges of hiring and managing full-time accountants—high costs, turnover risks, limited expertise, and compliance concerns—while providing a flexible, expert-driven solution. By partnering with a third-party provider, SMBs can save money, reduce stress, and focus on what they do best: growing their business.

If you’re tired of the hiring struggle and ready for a smarter way to manage your accounting, consider exploring third-party services that align with your budget and needs. Your business deserves financial clarity and stability—without the headaches.

Let’s Partner for a Stress-Free Future

Stop the cycle of hiring headaches and let Rudolph Corporate Service handle your accounting needs.

With our expertise and comprehensive services, you can focus on growing your business with confidence.

Contact us at hello@rudolphservice.com or call +977-9851152761.

Other Blogs